Tritium, a prominent Australian electric vehicle (EV) charging equipment manufacturer, has announced its insolvency after facing significant challenges in the US market. The company, which once thrived in the EV sector, has filed for administration, marking a pivotal moment in its trajectory. In a recent filing with the US Securities and Exchange Commission (SEC) on April 18, 2024, Tritium acknowledged its financial distress, leading to the appointment of administrators.

The filing identified several Australian subsidiaries, including Tritium Pty Ltd, Tritium Holdings Pty Ltd, and Tritium Nominee Pty Ltd, as insolvent or at risk of insolvency.

As part of the restructuring process, Tritium has proposed the appointment of Peter Gothard, James Dampney, and William Colwell from KPMG as joint administrators to oversee the company’s affairs. Additionally, McGrathNicol’s restructuring team has been appointed as receivers and managers to stabilize operations and explore potential avenues for recovery.

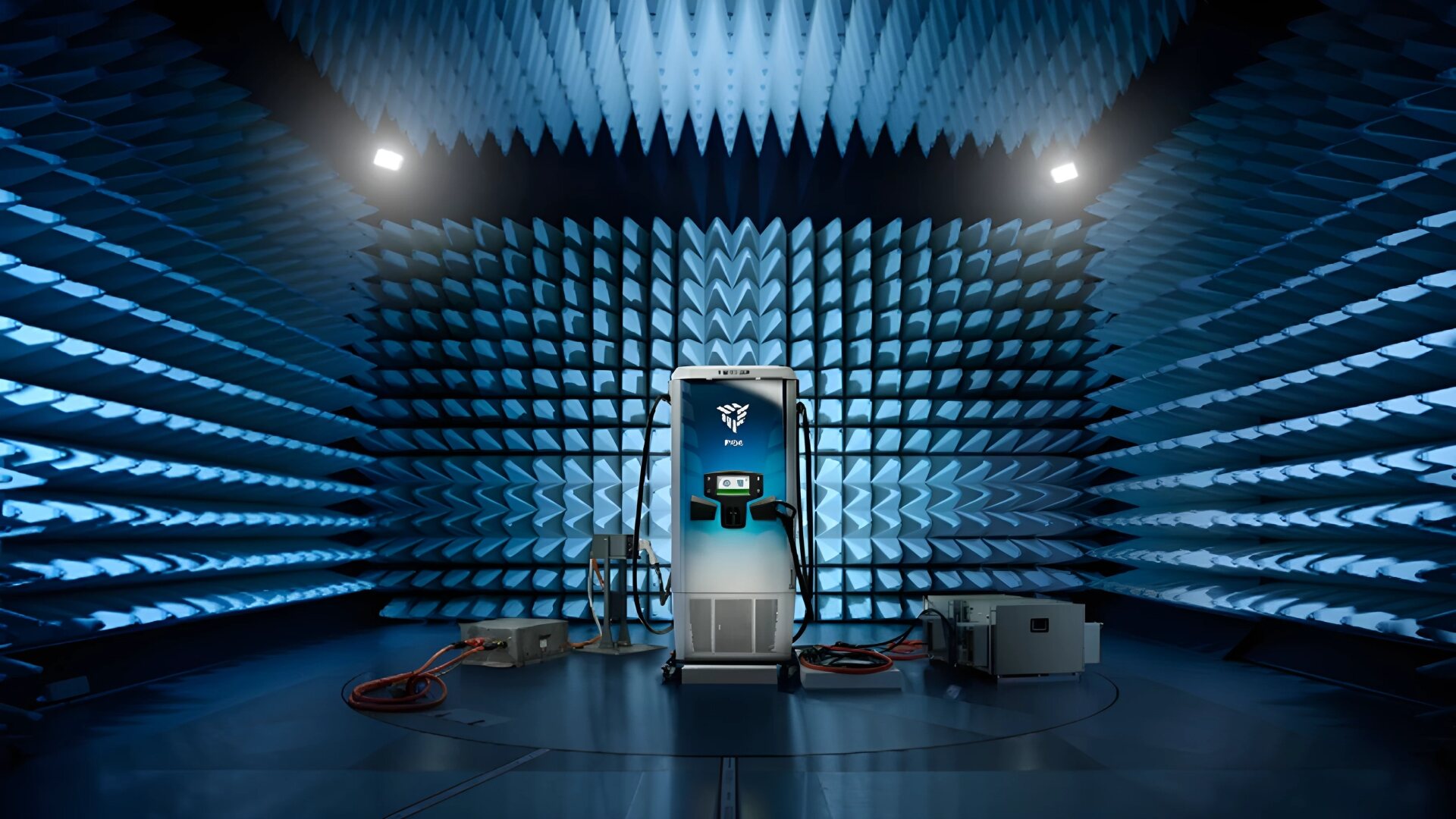

The company began in 2001 as an engineering consulting firm in Brisbane, eventually establishing itself as a key player in the EV charging market. Tritium achieved notable milestones, including introducing its first DC fast charger in 2013 and securing partnerships with major industry players like BP. Despite initial success, Tritium faced mounting challenges, including a decline in its share price and the threat of delisting from Nasdaq.

The company’s decision to consolidate manufacturing operations in the US further strained its financial position, leading to a downward spiral. Brian Flannery, a significant investor in Tritium, expressed concerns over the company’s strategic decisions, citing delays in relocating manufacturing facilities and addressing operational issues. Flannery’s decision to divest his stake in the company underscored growing skepticism among investors.

Tritium’s Nasdaq troubles culminated in a reverse stock split and subsequent delisting determination, further exacerbating its financial woes. Despite efforts to secure external funding from government sources, Tritium’s attempts to regain stability proved unsuccessful.

Former employees of Tritium have voiced criticisms of the company’s management and product quality, highlighting internal challenges that contributed to its downfall. Issues with design flaws and accountability within the organization have been cited as factors affecting product reliability and morale. As Tritium maneuvers the complexities of administration, stakeholders remain hopeful for a viable path forward that preserves the company’s legacy and potential for future success.