California is exploring a new way to make electric vehicle (EV) owners contribute to road funding, raising questions about privacy, long-distance commutes, and who ultimately pays the bill.

The state’s ambitious plan to reach carbon neutrality by 2045 depends heavily on widespread EV adoption, which will gradually phase out gas-powered cars and the revenue they generate through the gas tax.

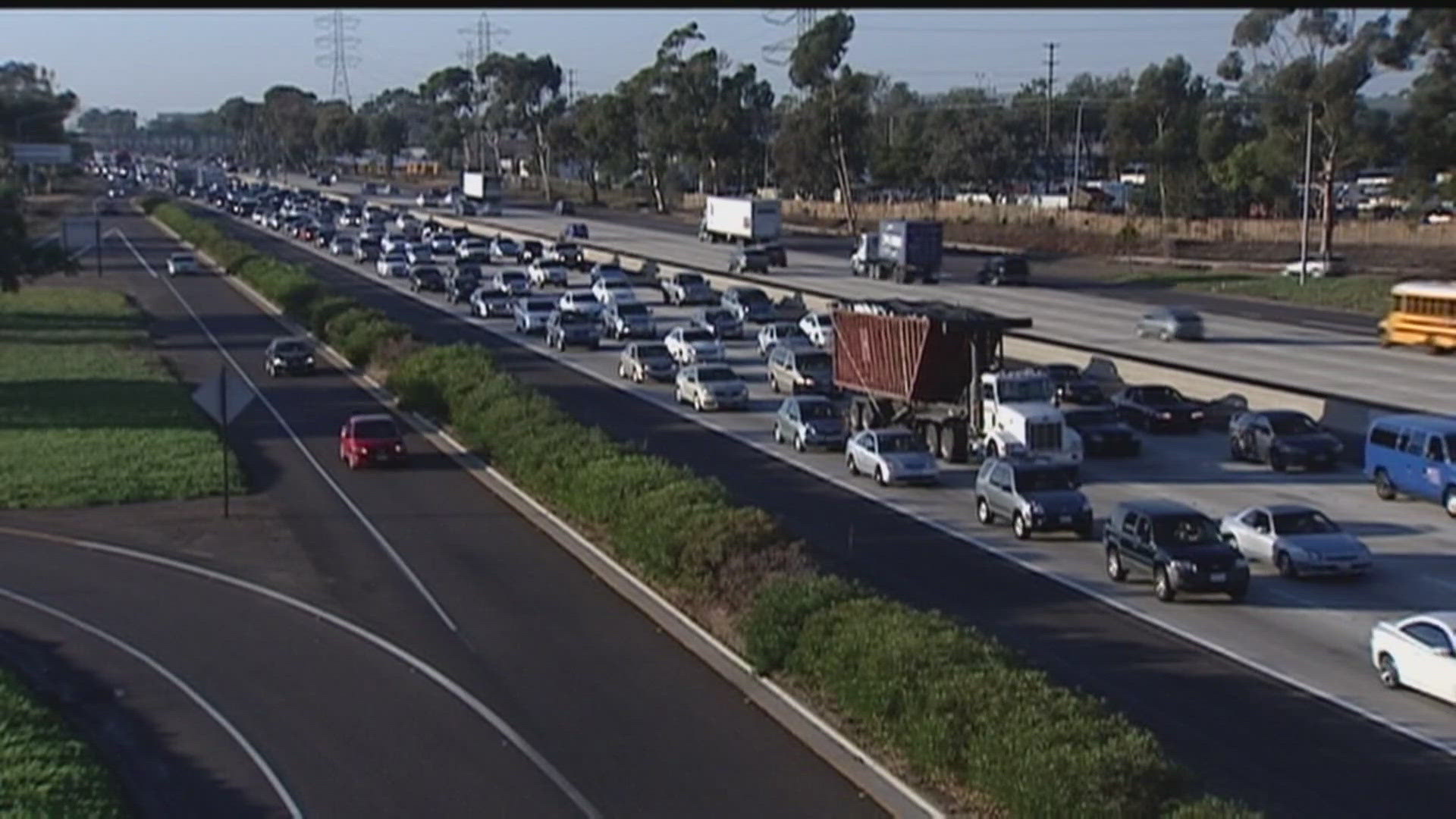

Currently, about 80 percent of California’s road maintenance budget comes from gas taxes. For every gallon of fuel purchased, roughly 61 cents go toward maintaining the state’s extensive highways, freeways, and local roads.

As more drivers switch to EVs, this revenue stream is expected to shrink significantly, prompting officials to test alternative methods to fund infrastructure.

One such alternative is a per-mile road tax for EV drivers. Earlier this year, California completed a pilot program that would charge EV owners between 2 and 4 cents for every mile driven.

In theory, this approach provides a straightforward way to fund road maintenance without relying on fossil fuels. However, implementing the system could prove complex and costly.

For drivers with long commutes, particularly those in rural areas, the proposed tax could add up quickly. Over a month or a year, this becomes a significant expense for people who may have few alternatives to driving.

Another challenge lies in monitoring each vehicle’s mileage. One suggested method involves installing a tracking device that plugs into the car and records miles driven.

Rolling out this technology across California’s EV fleet would be expensive and introduces concerns about driver privacy. Many residents may object to being monitored so closely, particularly if the data could be accessed by third parties or used for purposes beyond taxation.

David Kline of the California Taxpayers Association acknowledged the rationale behind the road tax: “Someone’s got to pay for the roads,” he said. “It should be the people who use the roads.”

However, he also warned that the tax could shift the burden unfairly: “Switching the burden to different people” might disproportionately affect those with long commutes who may struggle to afford the new cost.

As California evaluates its next steps, the balance between fairness, practicality, and privacy remains an open question.

Also Read: Top Quickest Quarter-Mile Production Cars of the 2000s – Ranked and Explained