Road usage charging (RUC), also referred to as mileage-based user fees (MBUF), vehicle miles traveled (VMT), or distance-based user fees (DBF), is a government initiative that imposes fees based on miles driven rather than fuel consumption.

This approach serves as an alternative funding mechanism designed to support road maintenance and infrastructure development, potentially supplementing or replacing the existing fuel tax.

Historical Context of the Federal Gas Tax

To understand road usage charging, it is essential to examine the history of the federal gas tax. Initially introduced in 1932 during the Great Depression, the tax was intended to generate federal revenue at a rate of one cent per gallon.

By the time the Highway Trust Fund was created over two decades later, the gas tax had evolved into a key funding source for highway construction and maintenance. However, despite inflation and increasing infrastructure costs, the tax has remained stagnant at 18.4 cents per gallon since 1993.

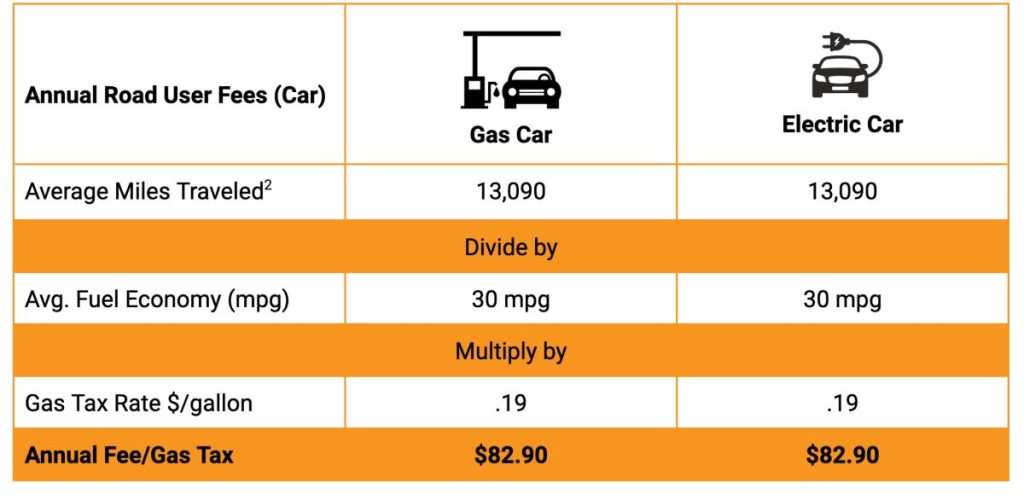

Over the years, the Highway Trust Fund has faced recurrent shortfalls due to the fixed nature of the fuel tax, advances in vehicle fuel efficiency, and the growing adoption of electric vehicles.

While the gas tax historically played a crucial role in financing transportation infrastructure, its purchasing power has steadily declined due to inflation and shifting transportation trends.

Addressing the Decline in Fuel Tax Revenues

As fuel tax revenues continue to decrease, alternative funding solutions have become necessary. With many states aiming for a full transition to electric vehicles by 2035 and light-duty vehicle transitions by 2027, raising the fuel tax is unlikely to provide a sustainable solution for transportation funding.

Many policymakers advocate for RUC programs, as they offer a viable means to generate consistent revenue for maintaining and upgrading transportation infrastructure.

Advantages of Road Usage Charging

RUC programs are designed with core principles such as fairness and long-term financial stability:

- Fairness: Unlike traditional fuel taxes, which are based on fuel purchases, RUC directly correlates charges with road usage. This ensures that drivers who travel more or operate heavier vehicles contribute proportionally to road maintenance costs. Additionally, lower-income communities that rely on older, less fuel-efficient vehicles could experience financial relief under RUC systems.

- Revenue Stability: Since RUC is independent of fuel consumption trends, it provides a more reliable revenue source. The funds collected through RUC are allocated directly to transportation projects and maintenance needs, ensuring that resources are directed where they are most required.

- Encouragement of Efficiency: By promoting alternative transportation modes such as carpooling, biking, walking, and the use of fuel-efficient vehicles, RUC contributes to reduced congestion, lower greenhouse gas emissions, and minimized wear and tear on infrastructure.

- Flexibility: RUC can be implemented through various models, including registration fees, congestion pricing, and pay-per-mile charges. Technological advancements further facilitate the integration of RUC systems within smart city and transportation initiatives.

- Future Planning: The data collected from RUC programs provides insights into travel patterns and road usage, enabling more informed transportation planning and investment decisions.

Road Usage Charging Initiatives Across the United States

Different states have adopted various approaches to RUC, including active programs, pilot projects, research initiatives, and states with no activity. A map of RUC initiatives provides a visual representation of where these programs are being implemented.

Methods for Data Collection

To ensure accurate mileage tracking, RUC programs utilize several data collection methods:

- Embedded Telematics: These factory-installed systems in modern vehicles provide real-time mileage and location data. They support both GPS and non-GPS reporting.

- On-Board Diagnostics (OBD) Dongles: Drivers can install these plug-in devices into their vehicle’s diagnostic port. The dongles capture and transmit mileage data to RUC programs.

- Self-Reported Odometer Photos: Drivers manually submit photos of their odometer readings. While accessible to all users, this method does not provide location data.

- Smartphone Applications: GPS-enabled mobile apps track mileage data. This option is gaining traction due to smartphone accessibility, though accuracy may vary compared to plug-in devices.

- Hybrid Approach: A combination of two or more data collection methods enhances accuracy and flexibility.

Challenges in Implementing Road Usage Charging Programs

Despite its benefits, implementing RUC programs presents challenges in planning, execution, and public perception:

- Privacy and Security: Ensuring data security and user trust is essential. Clear policies on encryption, data management, and incident handling must be established to mitigate privacy concerns and potential breaches.

- Equity Considerations: While RUC aims to enhance fairness in transportation funding, disparities among income levels, geographic locations, and vehicle types must be addressed. Variable pricing structures, similar to toll systems, can help accommodate different demographics fairly.

- Technological Implementation: Developing and integrating RUC technology requires significant investment and coordination between public and private sectors. Seamless interoperability with existing systems is crucial for user convenience and administrative efficiency.

The Role of Road Usage Charging in Future Transportation Funding

By addressing the limitations of traditional fuel tax revenues, RUC presents a forward-thinking funding model that aligns with modern infrastructure demands and evolving vehicle technologies:

- Adapting to Vehicle Trends: As fuel-efficient and electric vehicles gain popularity, fuel tax revenues continue to decline, creating a funding gap. RUC ensures that all road users contribute fairly to transportation funding, irrespective of their vehicle type.

- Targeted Infrastructure Investment: RUC programs generate detailed data on travel patterns, allowing for more precise transportation planning. This enables strategic investment in critical infrastructure projects, directing resources to areas of highest need and impact.

- Integration with Emerging Technologies: RUC systems are designed to work seamlessly with smart city initiatives, connected infrastructure, and autonomous vehicle technologies. This adaptability ensures that transportation funding mechanisms remain effective and relevant amid evolving mobility trends.

As the transportation landscape evolves, adopting road usage charging will be crucial in establishing a resilient and sustainable infrastructure funding model. By embracing this innovative approach, policymakers can ensure that transportation systems remain efficient, equitable, and prepared for future challenges.