Finding the right car loan can significantly impact your financial health and car-buying experience. With numerous financing options available, it’s essential to go through the process carefully to secure a loan that fits your budget and needs.

Whether you’re a first-time car buyer or looking to upgrade your vehicle, understanding the key factors involved in car loans will help you make an informed decision.

From comparing interest rates to considering your credit score, each step in the process requires careful consideration. In this guide, we’ll explore ten tips to help you find the right car loan, ensuring that you get the best deal possible while minimizing financial stress.

1. Check Your Credit Score

Your credit score plays a crucial role in determining the interest rate and terms of your car loan. Lenders use your credit score to assess your creditworthiness and the risk of lending to you. Before applying for a car loan, check your credit score and review your credit report for any errors or discrepancies. You can obtain a free credit report from major credit bureaus like Equifax, Experian, and TransUnion.

If your credit score is low, consider taking steps to improve it before applying for a loan. Paying off outstanding debts, making timely payments, and reducing your credit card balances can positively impact your credit score. A higher credit score can help you qualify for lower interest rates and better loan terms, saving you money over the life of the loan.

2. Determine Your Budget

Before you start shopping for a car loan, it’s essential to determine how much you can afford to borrow. Consider your monthly income, expenses, and other financial commitments to calculate a realistic budget for your car purchase. Use online calculators to estimate your monthly car loan payments based on the loan amount, interest rate, and loan term.

It’s important to consider not only the loan payment but also other costs associated with car ownership, such as insurance, maintenance, fuel, and registration fees. By setting a clear budget, you can avoid overextending yourself financially and ensure that your car loan fits comfortably within your financial plan.

3. Shop Around for Lenders

Not all lenders offer the same loan terms and interest rates, so it’s crucial to shop around and compare offers from multiple lenders. Banks, credit unions, online lenders, and dealership financing are all potential sources of car loans. Each lender may have different criteria for approving loans and varying interest rates, so obtaining multiple quotes can help you find the best deal.

When comparing loan offers, pay attention to the annual percentage rate (APR), loan term, monthly payment, and any additional fees or charges. A lower interest rate can save you money over the life of the loan, but it’s also important to consider the cost and terms of the loan.

4. Get Pre-Approved for a Loan

Getting pre-approved for a car loan can give you an advantage when negotiating with dealers and help you stay within your budget. Pre-approval involves submitting a loan application and providing financial information to a lender, who will then assess your creditworthiness and determine the loan amount and terms you qualify for.

With a pre-approval in hand, you can shop for cars with confidence, knowing how much you can afford to spend. Pre-approval also gives you leverage when negotiating the price of the car, as it shows dealers that you are a serious buyer with financing already secured.

5. Consider Loan Terms

The term of your car loan, or the length of time you have to repay the loan, can impact your monthly payments and the cost of the loan. Car loans typically range from 36 to 72 months, with shorter terms resulting in higher monthly payments but lower interest costs, and longer terms offering lower monthly payments but higher interest costs.

Consider your financial situation and long-term goals when choosing a loan term. While a longer term may result in lower monthly payments, it can also mean paying more in interest over the life of the loan. On the other hand, a shorter term may require higher monthly payments but can help you save on interest and pay off the loan faster.

6. Review Loan Agreements Carefully

Before signing any loan agreement, take the time to review the terms and conditions carefully. Make sure you understand the interest rate, monthly payment amount, loan term, and any additional fees or charges. Pay attention to details such as prepayment penalties, late payment fees, and any clauses related to default or repossession.

If there are any terms or conditions that you don’t understand, don’t hesitate to ask the lender for clarification. It’s important to know exactly what you are agreeing to before committing to a car loan. Reviewing the loan agreement thoroughly can help you avoid surprises and ensure that you are comfortable with the terms.

7. Consider the Total Cost of the Loan

When evaluating car loan offers, it’s important to consider the total cost of the loan, not just the monthly payment. The total cost includes the loan principal, interest, and any additional fees or charges. By focusing on the total cost, you can get a clearer picture of the financial commitment and make a more informed decision.

A lower monthly payment may seem attractive, but it could also mean a longer loan term and higher total interest costs. Use online calculators to compare different loan scenarios and understand how factors such as interest rates and loan terms impact the total cost of the loan.

8. Negotiate with Dealers

When negotiating the price of a car, having a pre-approved loan can give you additional leverage. Dealers may offer financing options, but they are not always the best deals available. Be prepared to negotiate the price of the car separately from the financing. By focusing on the car price first, you can avoid potential markups or hidden fees associated with dealership financing.

Let the dealer know that you have a pre-approved loan and are open to comparing their financing offer. If the dealer can match or beat your pre-approved loan terms, you may be able to secure an even better deal. Remember that negotiation is a two-way process, and being informed and confident can help you get the best possible outcome.

9. Understand Your Rights

As a borrower, it’s important to understand your rights and protections when it comes to car loans. Federal and state laws regulate lending practices and provide protections for consumers. Familiarize yourself with your rights under the Truth in Lending Act, which requires lenders to disclose key loan terms and costs.

Additionally, be aware of any state-specific regulations that may apply to car loans. Knowing your rights can help you identify any unfair or deceptive practices and ensure that you are treated fairly throughout the loan process.

10. Consider Gap Insurance

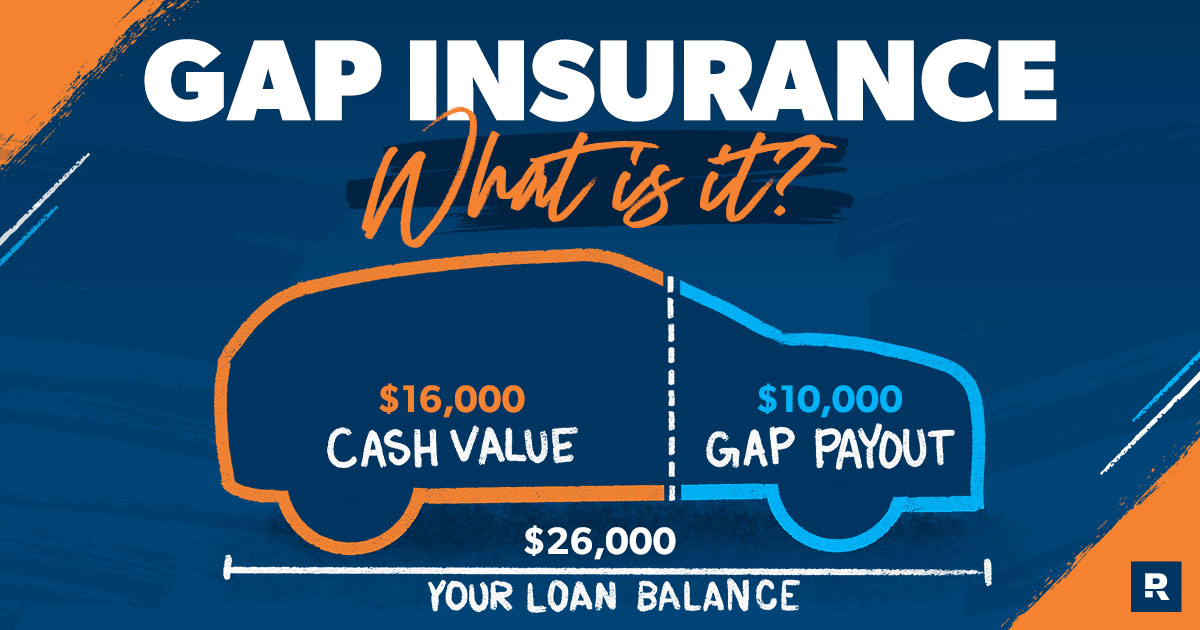

Gap insurance, or Guaranteed Asset Protection insurance, is an optional coverage that can protect you in case your car is totaled or stolen and the insurance payout is less than the outstanding loan balance. Gap insurance covers the “gap” between the car’s actual cash value and the remaining loan balance, preventing you from having to pay out of pocket for the difference.

Consider whether gap insurance is right for you based on factors such as your down payment, loan term, and the rate of depreciation of your car. While it may add to the cost of your loan, gap insurance can provide valuable protection and peace of mind in the event of an unexpected loss.