India announced on Friday a reduction in import taxes on specific electric vehicles (EVs) from car manufacturers committing to invest a minimum of $500 million and commence domestic production within three years, marking a significant boost to Tesla’s prospects in the market.

The policy shift aligns closely with Tesla’s lobbying efforts in New Delhi, despite facing resistance from local carmakers.

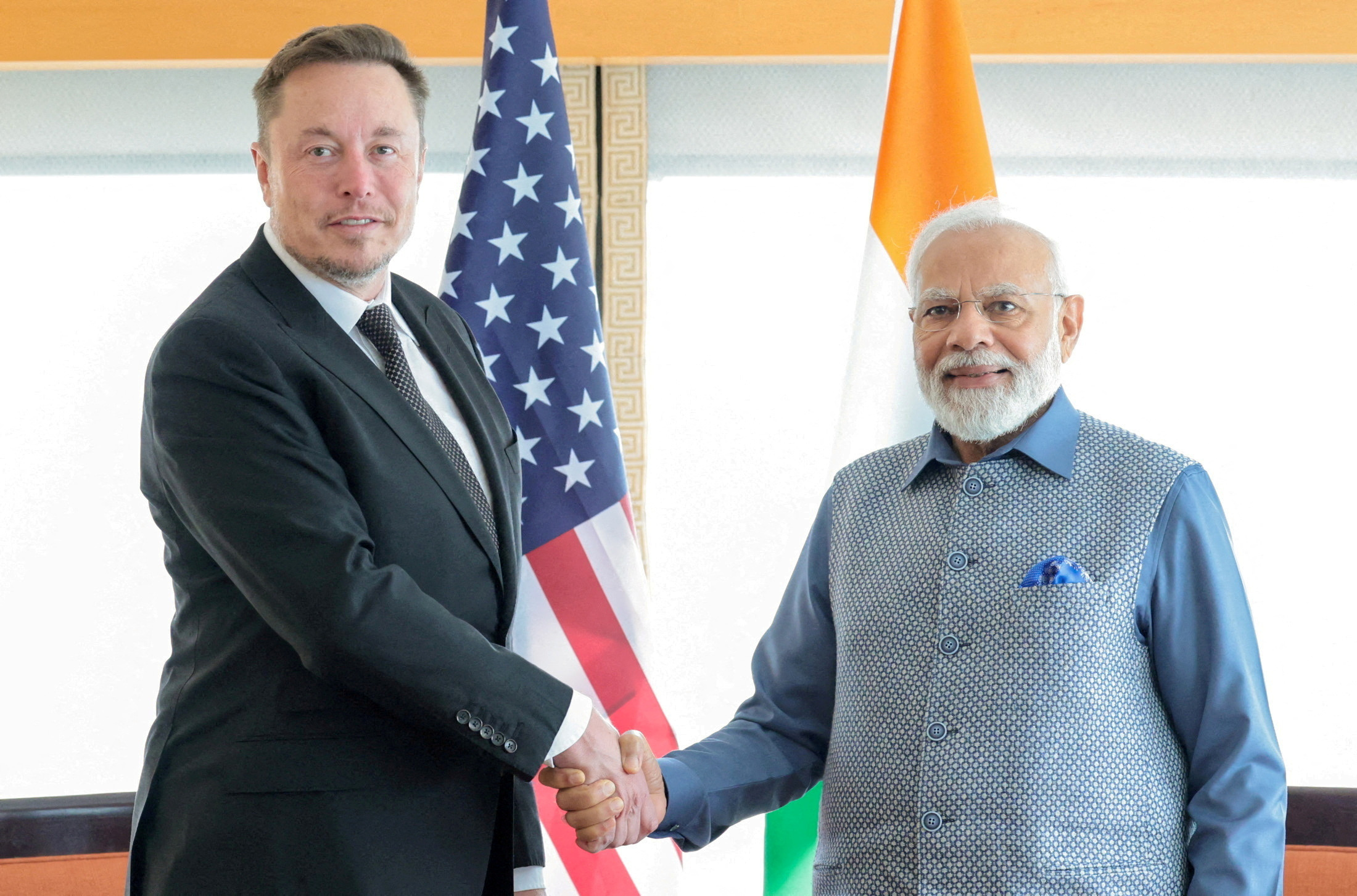

Elon Musk, CEO of Tesla, has sought entry into the Indian market for several years, with New Delhi insisting on a commitment to local manufacturing. Musk engaged in multiple visits to India over the past year, including a meeting with Prime Minister Narendra Modi in June.

In July, sources revealed that the U.S. automaker proposed manufacturing a $24,000 vehicle at a yet-to-be-constructed factory but requested a reduction in import duties, which Musk identified as among the highest globally.

Effective immediately, the new policy allows qualifying companies to import up to 8,000 EVs annually, priced at $35,000 or more, at a reduced tax rate of 15%. Currently, India imposes import duties of 70% or 100% on EVs, depending on their value.

Notably, Tesla’s entry-level vehicle, the Model 3, starts at $38,990 in New York. However, the company did not respond to inquiries seeking comment.

“We invite global companies to come to India. I’m confident India will become a global hub for EV manufacturing and this will create jobs and improve trade,” stated Commerce Minister Piyush Goyal during a press briefing.

India’s EV market, although small, is on an upward trajectory, with Tata Motors dominating sales. Electric vehicle sales constituted approximately 2% of total car sales in India in 2023, with the government aiming for a 30% share by 2030.

Imports of EVs at the reduced tax rate will be permitted for a maximum of five years, with the duty foregone limited to the company’s investment or approximately $800 million, whichever is lower.

The policy revision arrives amidst a slowdown in global EV sales growth, presenting an opportunity for new entrants in the world’s third-largest automotive market.

“This will open up the world’s third-largest auto market to new carmakers, suppliers, technologies and the overall EV ecosystem,” remarked Gaurav Vangaal, associate director at S&P Global Mobility.

Tesla, facing challenges including a lack of entry-level models and an aging lineup, contends with declining demand and heightened competition from rivals like China’s BYD.

Other contenders like Vietnam’s VinFast, seeking reduced EV import taxes, plan substantial investments, with construction already underway for a factory in Tamil Nadu.

India’s EV policy development, notwithstanding resistance from Tata Motors and rival Mahindra & Mahindra, aims to foster a competitive environment among EV players, as highlighted by the commerce ministry.