Stellantis has faced significant inventory challenges throughout 2024, especially with its Jeep and Ram brands, which, at one point, held more than double the industry average stock. Other Stellantis brands, such as Alfa Romeo, Chrysler, and Dodge, also had excess inventory, contributing to the company’s struggle with oversupply. This situation has created pressure on both the automaker and its dealerships, as holding large amounts of unsold stock ties up resources and limits flexibility in pricing and promotions, particularly as new model-year vehicles begin to arrive.

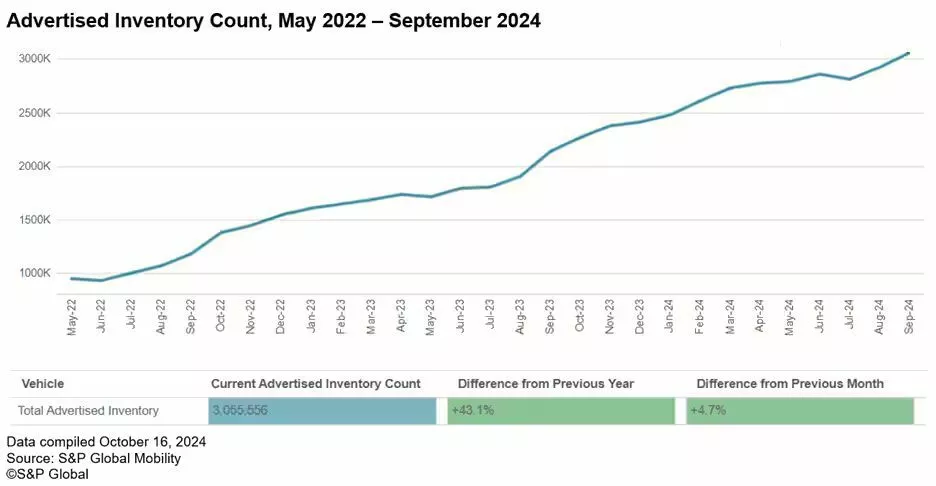

In September, however, Stellantis made progress in reducing some of its inventory. Data from S&P Global Mobility revealed that Jeep’s inventory fell by 4.1%, Ram’s by 1.4%, and Dodge saw a significant 9.1% drop. These reductions occurred even though the overall vehicle inventory in the U.S. surged to a record 3.056 million vehicles, up 4.7% from the previous month. Despite the industry-wide increase in stock, Stellantis managed to reduce its own inventory levels, which stands out as a positive development for the company.

Other automakers also reported inventory reductions during this period. Brands like Audi, Cadillac, and Lincoln saw slight drops in their stock levels, while the electric vehicle (EV) market experienced a 2.6% decrease in inventory. This drop marks a shift from the previous trend of rising EV stock and indicates that supply and demand within the electric vehicle segment are starting to stabilize. As of the end of September, there were approximately 167,831 EVs in inventory across the U.S., reflecting more balanced supply levels compared to earlier in the year.

The rise in overall inventory can be attributed in part to the influx of 2025 model-year vehicles, which increased by 45.6% between August and September. As these new models arrived on dealership lots, inventories of 2024 models decreased by 10.1%, and the stock of 2023 models fell by 19%. This turnover of older models in favor of new ones is typical at this time of year but contributes to the overall swelling of vehicle inventories across brands.

Additionally, S&P Global Mobility reported an increase in both vehicle prices and dealer discounts. The average manufacturer’s suggested retail price (MSRP) for new vehicles rose by 3.3% to $52,066, while the average dealer list price climbed 2% to $48,460. At the same time, the average discount on new vehicles grew by 21.2% to $3,606. These pricing changes suggest that dealerships are using discounts more aggressively to attract buyers, as high inventory levels create the need for incentives to move stock.