The Trump transition team is considering a significant policy change that could have a major impact on the U.S. electric vehicle (EV) market: eliminating the $7,500 consumer tax credit for EV purchases. This potential move is part of broader tax reform efforts, which are being shaped by influential figures such as oil magnate Harold Hamm and North Dakota Governor Doug Burgum. The removal of the credit could complicate the transition to electric mobility in the U.S., a shift already facing hurdles in terms of adoption and infrastructure.

In a surprising twist, Tesla and its CEO, Elon Musk, have backed the idea of scrapping the tax credit. Musk argues that ending the subsidy could benefit Tesla in the long term by making it harder for competitors like General Motors (GM) and Ford to keep their electric vehicles affordable. Tesla, which dominates the U.S. EV market with nearly half of all EV sales, sees the credit as unnecessary for its business. However, the potential elimination of the tax credit has hit smaller EV companies like Rivian and Lucid hard, as their stock prices have dropped in response to the news.

The move to cut the EV tax credit aligns with President Trump’s promises during his campaign to roll back Biden’s clean energy policies, including the incentives for electric vehicles. Trump’s team views repealing the credit as a politically viable move that could gain support in a Republican-controlled Congress, while also providing potential savings that could be redirected into other tax cuts promised by the president. For Trump’s team, the elimination of the credit could be framed as a way to reduce government spending while fulfilling campaign pledges.

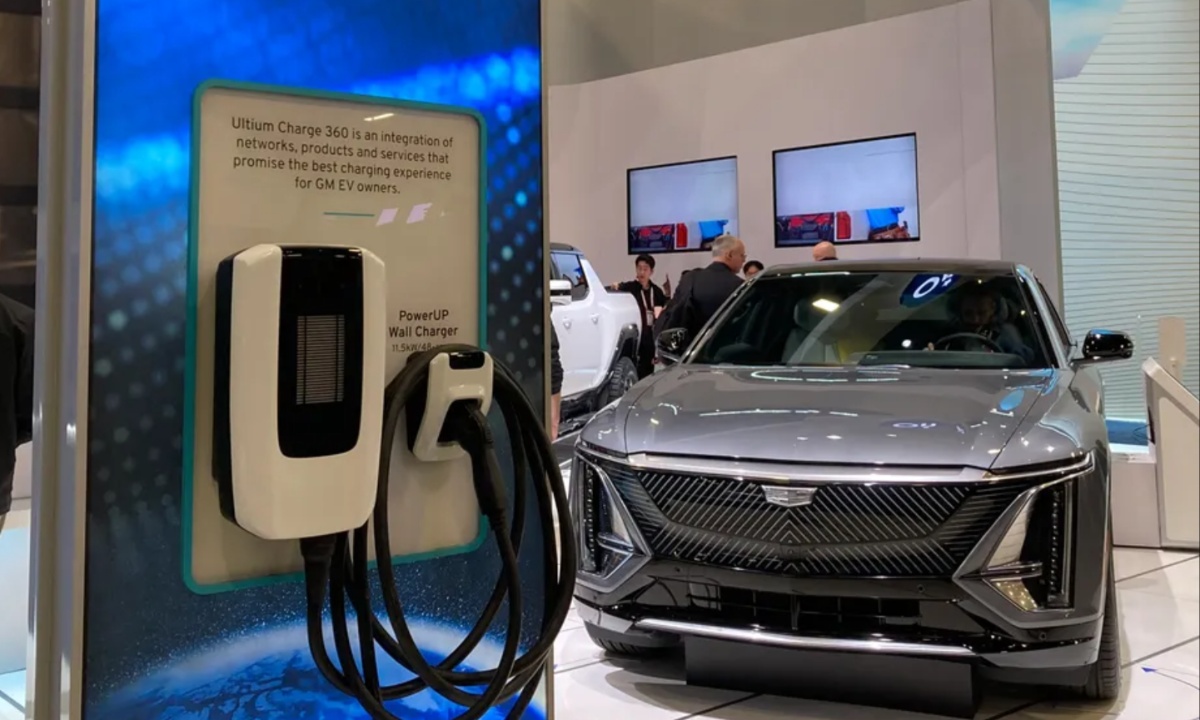

For established automakers like GM and Ford, however, the repeal of the EV tax credit would be a blow. These companies are still transitioning their production lines to electric vehicles, and the subsidy has been key in making their EVs more affordable to consumers. Ford, in particular, has faced difficulty generating demand for its electric F-150 Lightning, and the end of the credit could make it even harder to compete with Tesla’s pricing advantages. The United Auto Workers (UAW), which represents workers at these traditional automakers, has spoken out against the repeal, warning that it could lead to job losses in the auto sector.

Tesla, on the other hand, could be less affected by the loss of the subsidy due to its lower production costs and technological advantages. Additionally, the Biden administration’s policies, such as tariffs on Chinese-made EVs, might continue to benefit Tesla by keeping affordable foreign EVs out of the U.S. market. As the debate over the EV tax credit continues, its outcome will be pivotal in determining the future of electric vehicle adoption in the U.S., with the potential to either accelerate or hinder the transition to cleaner transportation.