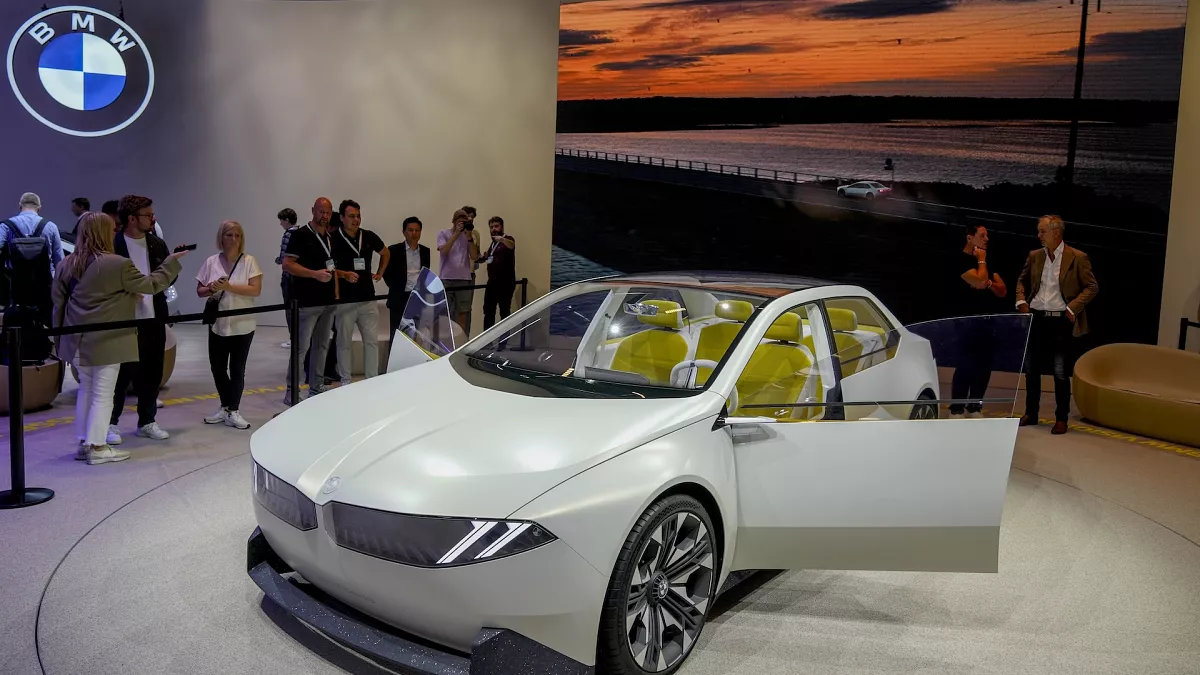

The British lending arm of BMW, BMW Financial Services (GB) Ltd, has set aside £70.3 million in its 2023 accounts to address potential compensation claims stemming from undisclosed motor finance commissions. This move marks BMW as one of the first major automakers to allocate a specific provision in response to a growing commission scandal, reflecting the company’s proactive approach to addressing customer grievances and ensuring regulatory compliance.

This provision is part of a larger industry-wide response, with total reserves reaching nearly £680 million across various lenders. Financial experts predict that these reserves could rise substantially, possibly reaching billions of pounds and rivaling the infamous £50 billion Payment Protection Insurance (PPI) scandal in scale. This underscores the potential magnitude of the issue and highlights the significant financial risks faced by the motor finance industry.

BMW’s accounts acknowledge uncertainties in estimating the total liability, especially following a recent Court of Appeal ruling. This October decision expanded lender accountability to include all undisclosed or partially disclosed commissions, not just discretionary ones. This ruling has raised the stakes for motor finance providers, forcing them to reevaluate their liability estimates and address transparency in their agreements with consumers.

The ruling has also prompted widespread operational adjustments, with BMW and other lenders temporarily pausing car loan activities to comply with the stricter disclosure requirements. The motor finance sector is undergoing significant disruption, as firms reassess their financial provisions and seek to align with the new legal standards. This marks a pivotal moment for the industry, with compliance and consumer trust becoming key priorities.

Major industry players like Lloyds Banking Group, FirstRand, and Investec have made provisions ranging from £30 million to £450 million, while others, such as Close Brothers and Santander UK, have yet to specify their reserves. BMW’s substantial provision underscores the severity of the crisis, signaling long-term ramifications for the sector. Analysts warn that the financial impact could strain credit ratings for some companies, further highlighting the far-reaching consequences of this scandal.