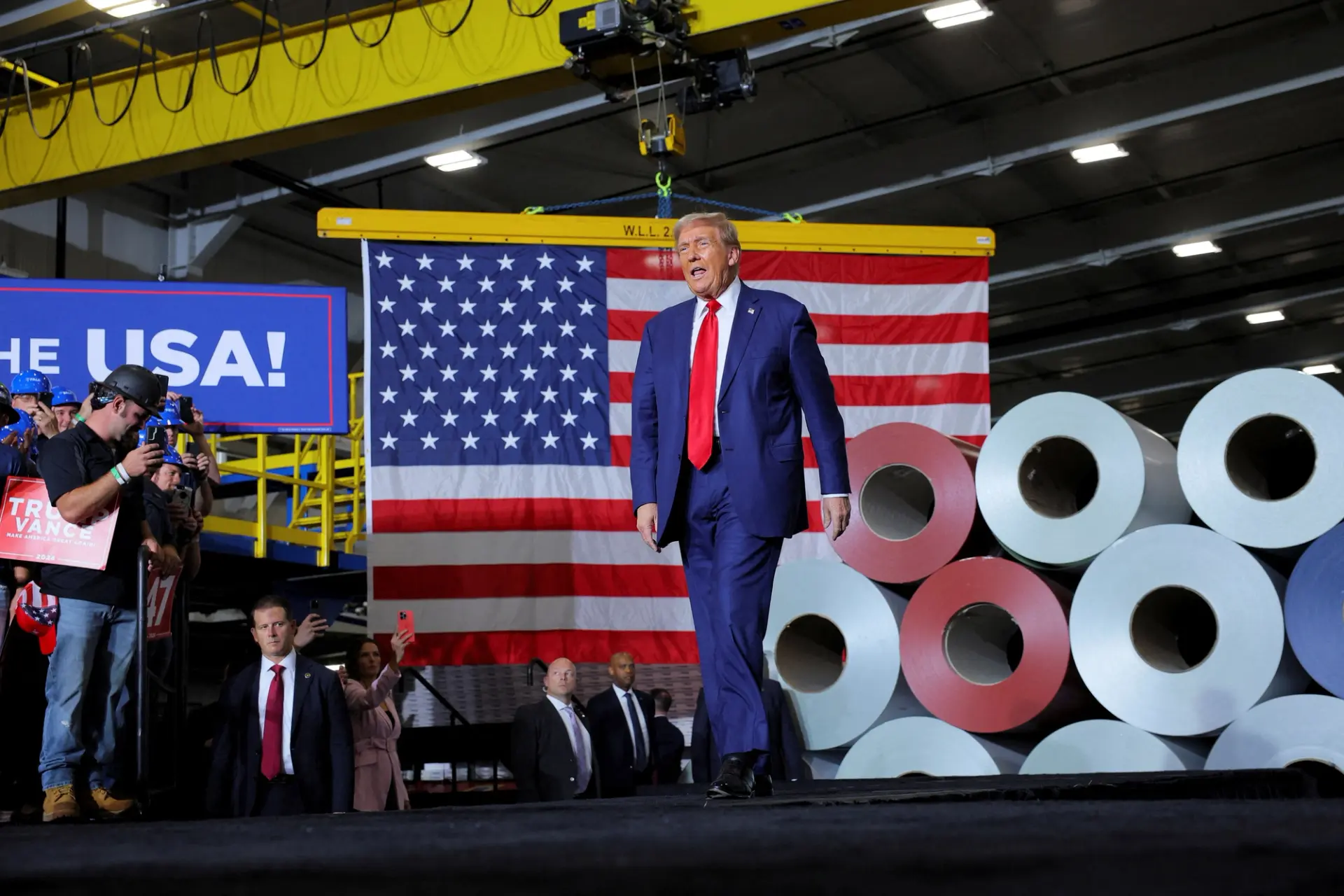

President Donald Trump has once again ignited trade tensions with his latest tariff threat. This time, the target is steel and aluminum imports, with the tariffs set to take effect on March 12. The announcement has caused significant frustration among U.S. trading partners, particularly Canada, one of America’s closest allies.

The unpredictable nature of these trade policies has left Canadian officials and businesses scrambling to respond. The uncertainty surrounding these tariffs has made it difficult for Canadian industries to plan for the future, leading to increased economic anxiety.

For Canada, the tariff threats have become an ongoing challenge. Matthew Holmes, the executive vice president of the Canadian Chamber of Commerce, described the situation as akin to a game of “whack-a-mole,” with shifting justifications for imposing tariffs.

Less than two weeks ago, the U.S. had paused a similar threat against Canada and Mexico in favor of imposing tariffs on China. Whether Canada will receive another reprieve remains uncertain. Canadian businesses are particularly concerned about the potential long-term impact on trade relations and supply chains, which have been carefully developed over decades.

Tariffs Threaten Cross-Border Trade and Economic Ties Between the U.S. and Canada

The United States and Canada share deeply interconnected economies. The Canadian Chamber of Commerce highlights that Canada is the top export destination for 34 U.S. states, including Michigan.

In December alone, bilateral trade between the two countries exceeded $62 billion, just behind U.S. trade with Mexico. The economic bond between the two nations is deeply rooted in industries such as manufacturing, agriculture, and natural resources.

Detroit and Windsor, Ontario, exemplify the close economic ties. Governor Gretchen Whitmer has emphasized that the Detroit-Windsor border crossing is the busiest in North America, facilitating more than a quarter of the $700 billion in annual trade between the two nations.

Tariffs on steel and aluminum threaten to disrupt this crucial trade flow, potentially causing delays in production and increasing costs for manufacturers on both sides of the border.

A major concern surrounding the tariffs is their potential impact on the North American auto industry. Ford CEO Jim Farley warned that imposing 25% tariffs on Canadian and Mexican products would “blow a hole in the U.S. industry that we’ve never seen.”

Since auto parts frequently cross borders multiple times during production, tariffs would significantly raise costs. Governor Whitmer noted that these costs would ultimately be passed on to consumers, making vehicles more expensive and potentially reducing consumer demand.

The intricate supply chain of the auto industry demonstrates the potential economic damage. Many components are assembled in Canada before being shipped to U.S. plants for final production.

The removal of duty drawbacks, which previously exempted components from multiple tariffs, would add further strain to the industry. If tariffs are enforced, companies may have to reconsider their production strategies, potentially shifting jobs and operations to other regions to mitigate financial losses.

Also Read: Top 10 Affordable Electric Cars You Can Buy in 2025

How Tariffs on Canada Could Disrupt Key Industries and Raise Consumer Costs

Trade between the U.S. and Canada has been governed by agreements such as the North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA).

However, an earlier agreement, the 1965 Canada-U.S. Automotive Products Agreement (Auto Pact), played a pivotal role in integrating the auto industries of both countries. It allowed manufacturers to optimize production by consolidating operations across borders, leading to efficiency gains and lower production costs.

If the proposed tariffs are implemented, experts like Sam Abuelsamid of Telemetry Insights foresee a return to pre-Auto Pact conditions, with reduced trade and increased costs. The impact would include smaller production volumes, layoffs, and higher vehicle prices. Automakers may be forced to scale back production or increase prices to offset additional costs, which could have a ripple effect throughout the economy.

Beyond the auto industry, Canada’s contributions to the U.S. economy include industrial inputs like lumber, uranium, chemicals, and oil. Canada is the largest supplier of oil to the U.S., and many American refineries are specifically designed to process Canadian crude. Tariffs could disrupt these supply chains, leading to price increases across multiple sectors, including energy, construction, and manufacturing.

Agriculture is another area of concern. Canadian greenhouses supply a significant portion of the fresh produce consumed in the U.S., such as tomatoes and peppers. Tariffs on these goods would lead to higher prices for consumers, affecting household budgets and potentially altering food availability.

Additionally, Canadian farmers and agricultural businesses may struggle to find alternative markets for their products, resulting in financial instability.

Canada’s Potential Retaliatory Measures

If the tariffs are imposed, Canada is expected to respond with retaliatory tariffs of its own. In response to previous threats, the Canadian government announced a list of products that could face a 25% tariff.

These included everyday goods such as orange juice, peanut butter, wine, spirits, beer, coffee, appliances, apparel, footwear, motorcycles, cosmetics, and paper products. Such measures would increase costs for U.S. exporters and could escalate into a broader trade war, impacting businesses on both sides of the border.

Canadian officials have made it clear that they are prepared to take firm action if necessary. The imposition of tariffs could damage diplomatic relations between the two countries, creating an atmosphere of uncertainty that may deter investors and hinder economic growth. Businesses on both sides of the border are urging policymakers to seek a resolution that avoids a full-blown trade conflict.

Rising Tensions as Tariffs Strain U.S.-Canada Relations Beyond Economic Consequences

Beyond the economic consequences, the tariff threats have strained the U.S.-Canada relationship. Reports of Canadians boycotting American products and booing the U.S. national anthem at sporting events indicate growing resentment and dissatisfaction with the Trump administration’s trade policies.

These actions reflect a broader sentiment that Canada is being unfairly targeted despite its long-standing alliance with the United States.

Matthew Holmes of the Canadian Chamber of Commerce noted that these tariffs feel like a “gut punch” to many Canadians, even those who are not typically engaged in trade policy discussions. The sense of betrayal has fueled public anger and increased pressure on Canadian officials to take a firm stance in trade negotiations.

David Soberman, a professor at the University of Toronto, believes that while the tariffs may not last long, they will still have a negative impact. He warns that retaliatory tariffs could trigger a trade war where both sides lose. The uncertainty surrounding these tariffs has also led to concerns among U.S. businesses, which rely on Canadian markets for revenue and growth opportunities.

President Trump’s renewed tariff threat on steel and aluminum has reignited trade tensions between the U.S. and Canada. The economic and political ramifications are significant, particularly for industries reliant on cross-border supply chains.

Tariffs could lead to higher prices, job losses, and increased costs for manufacturers and consumers alike. While the final outcome remains uncertain, one thing is clear: the imposition of tariffs could have lasting consequences for both nations.

Policymakers on both sides must carefully weigh their decisions to avoid escalating an unnecessary and damaging trade conflict. In the coming weeks, businesses and government officials will be closely monitoring developments, hoping for a resolution that preserves the stability of U.S.-Canada trade relations.

Also Read: 10 Best Performance Hatchbacks You Can Buy in 2025 for Speed, Style, and Practicality