Many Americans may benefit from President Trump’s new deduction on auto loan interest, though the financial relief it provides is expected to be modest.

An auto loan deduction arrives as the industry grapples with the effects of President Trump’s tariffs.

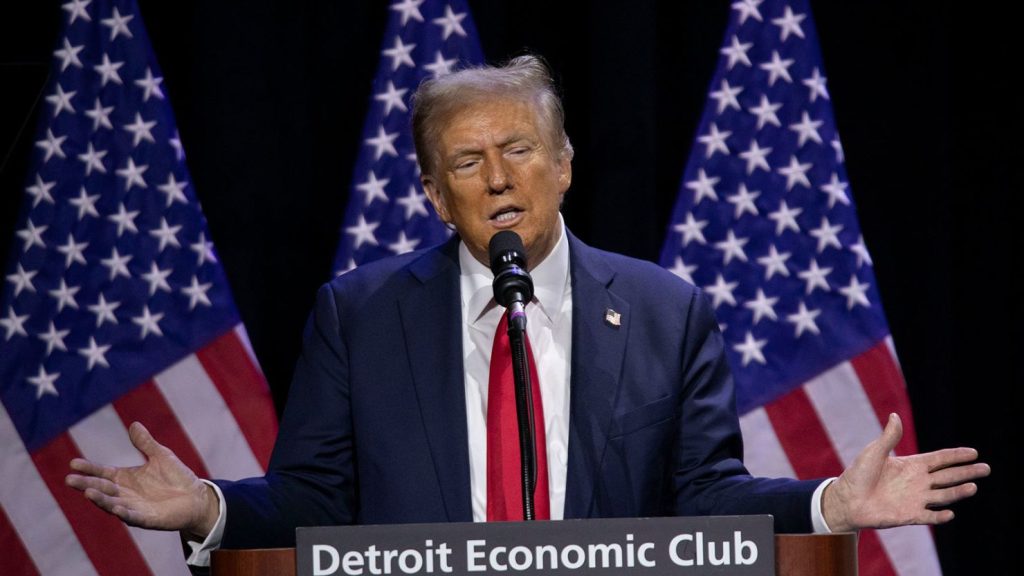

As President Trump and his Republican allies work to address rising affordability concerns, they have highlighted the sweeping tax-cut bill signed into law this past summer.

Mr. Trump and his advisers have promised Americans larger tax refunds next year, thanks in part to new breaks included in the legislation.

One of these, a deduction formally known as “no tax on car loan interest”, is expected to attract significant attention. However, for most consumers, it may provide only limited savings.

The deduction stems from a campaign promise Mr. Trump made in October 2024 to stimulate the domestic auto industry and make vehicles more affordable.

The domestic policy bill, signed into law in July, enacted the deduction. Yet, tax and automotive experts remain uncertain whether it will meaningfully lower costs for consumers or significantly boost the domestic auto sector.

The auto loan interest deduction is part of a broader Trump administration initiative to roll back electric vehicle subsidies and encourage more cars to be built in the United States.

In the same legislative action, the president eliminated subsidies for electric vehicles, a flagship policy under President Joseph R. Biden Jr.

A Hyundai factory in Ellabell, Ga. Under the new policy, cars must have their final assembly in the United States.

Senator Bernie Moreno, Republican of Ohio and a primary architect of the deduction, described it as an “immediate relief” from high auto prices, which he attributed to Mr. Biden’s electric vehicle subsidies and other Democratic policies.

Also Read: Top 10 Oldsmobiles That Quietly Became Serious Collector Cars