To cut costs in their base models, Tesla is leading the charge among Western car companies in adopting LFP battery technology.

While LFP cells boast affordability compared to nickel-based batteries, their lower energy density makes them better suited for situations prioritizing price over performance.

Advancements in LFP chemistry have narrowed the gap with high-nickel options in energy density and charging, but a key obstacle remains for wider Western adoption: dependence on Chinese imports.

Geopolitical tensions are pushing car companies to find alternatives to Chinese suppliers, with both Ford and Tesla exploring domestic LFP production to qualify for the Inflation Reduction Act’s $35/kWh battery production incentive in North America.

Tesla appears to be gearing up for domestic production of lithium iron phosphate (LFP) batteries in Nevada.

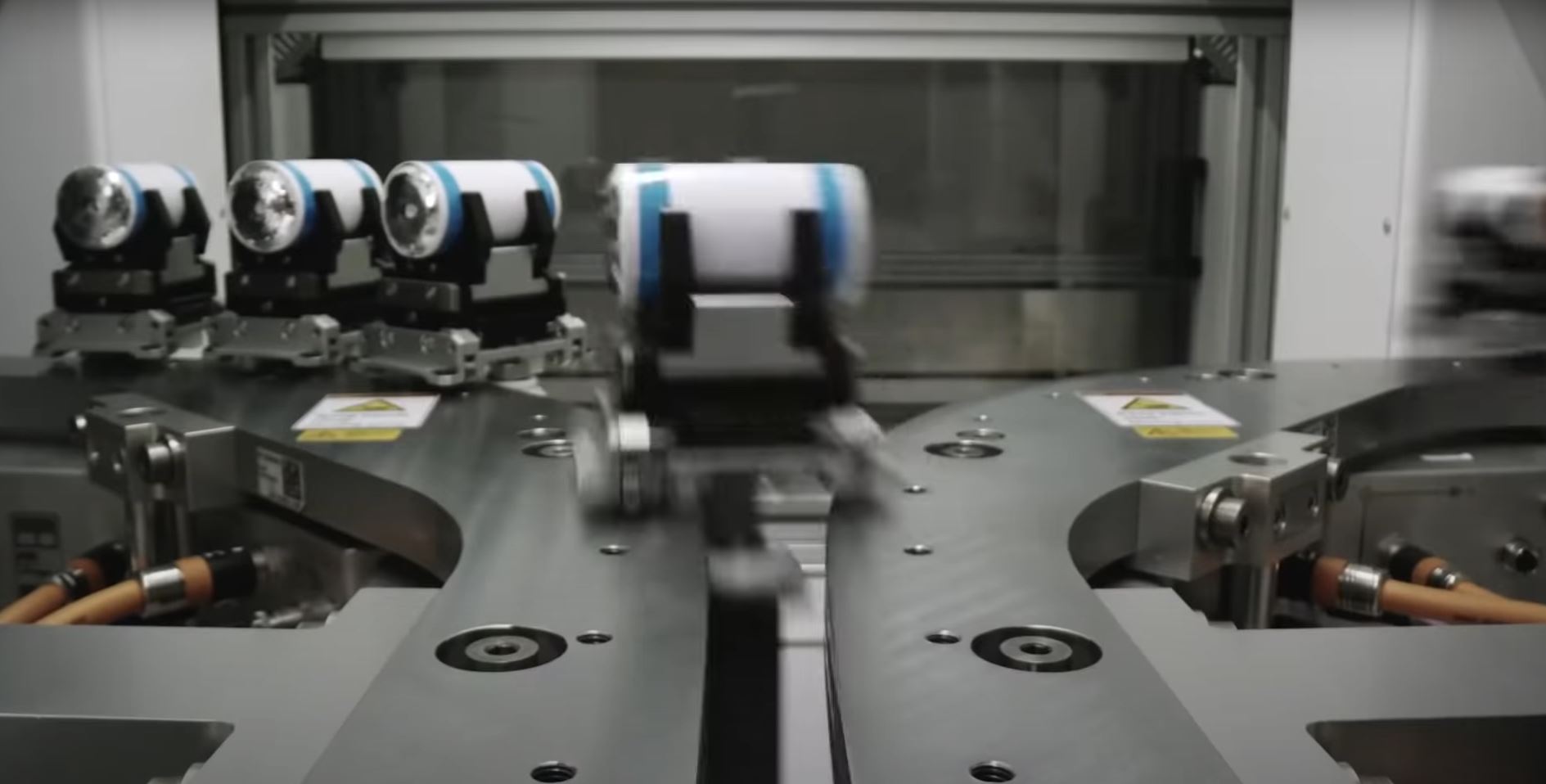

According to reports, the electric car giant is planning a new facility in Sparks, Nevada, utilizing equipment acquired from CATL, the world’s leading LFP battery producer.

This move comes amid growing interest in LFP batteries due to their affordability and readily available raw materials.

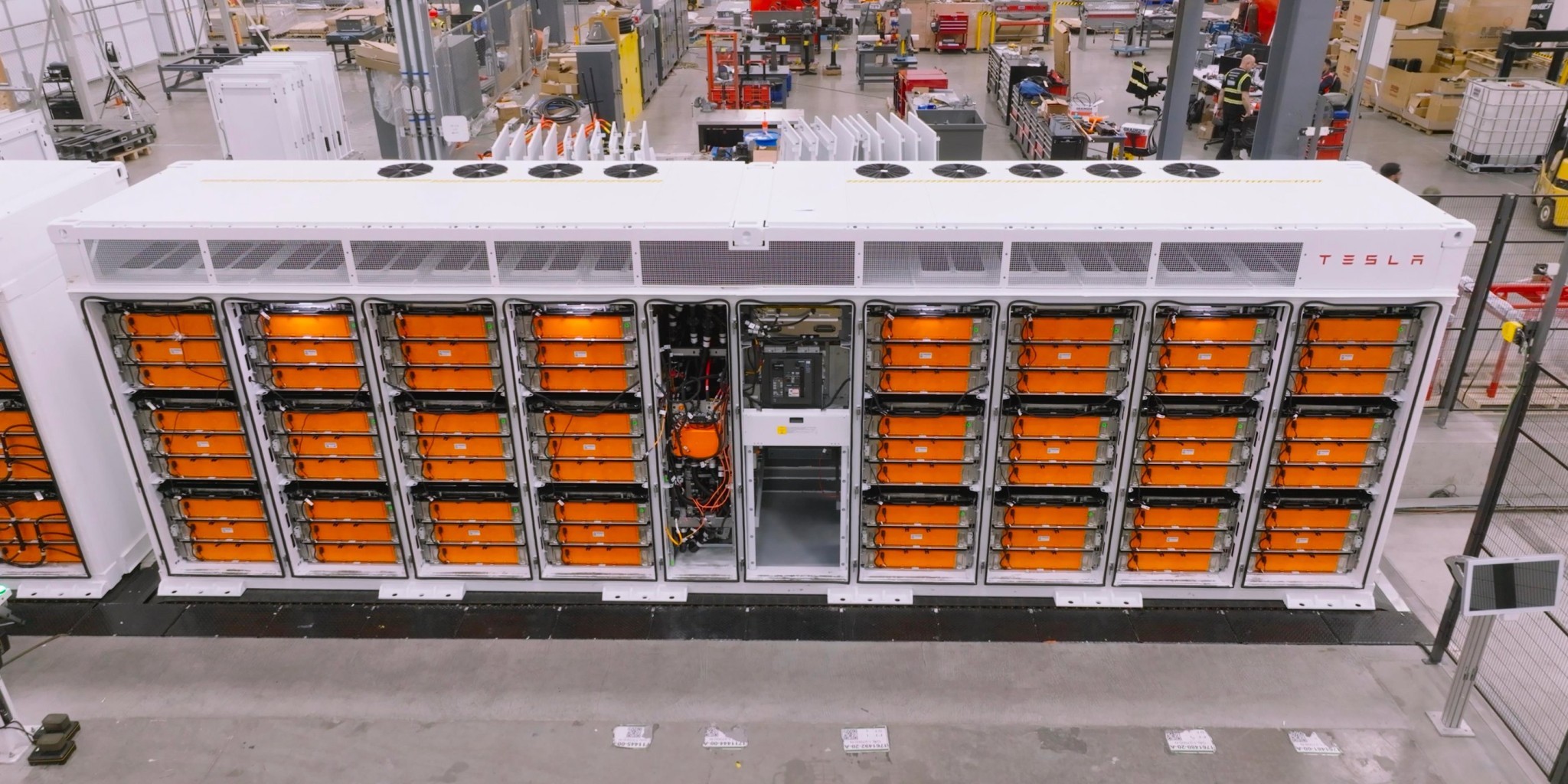

While initial production will be limited, targeting Tesla’s Megapack energy storage systems, plans reportedly involve expanding capacity to supply LFP cells for electric vehicle production at Tesla’s gigafactories.